The Ultimate Guide to Digital Asset Custody for Institutions

Even as challenging macroeconomic situations continue battering down on the tech sector, the growth of web3/blockchain-related businesses holds steady. As recently as Q3 2022, web3 companies were still dominating the lion’s share of venture capital (VC) dollars, according to the Emerging Tech Indicator (ETI) report.

Rising importance of digital asset custody

As web3/blockchain businesses continue to mushroom up, one topic takes center stage – Digital asset custody

This refers to the safeguarding and management of the cryptographic keys that control access to digital assets such as Bitcoin, Ethereum, and numerous other cryptocurrencies. The stakes are incredibly high. Mismanagement or loss of these cryptographic keys equates to the loss of the assets themselves, often running into millions, if not billions, of dollars.

Look no further than notable incidents like the $40 million Binance hack and the QuadrigaCX debacle, where a CEO’s death left $145 million in crypto assets inaccessible , which underlines the stark consequences of inadequate digital asset custody.

Hence, the function of digital asset custody, which includes a range of services from secure storage to seamless transaction handling, is increasingly sought after by institutions venturing into the digital asset space.

Securing Tomorrow's fortunes

Businesses That Require Strong Digital Asset Custody

By the very nature of their operations, these businesses often handle significant volumes of digital assets, whether that’s cryptocurrency or tokenized assets, on a daily basis. These assets, often being of substantial value, are a prime target for malicious actors who may attempt theft or fraud.

High Transaction Volumes

A Substantial User Base

Crypto-Based Operations

Some examples

Blockchain Gaming

Crypto Payment Providers

Crypto Exchanges

Web3 Merchants

Blockchain Gaming

As gaming ecosystems increasingly adopt blockchain technology and cryptocurrencies, safekeeping in-game assets and cryptocurrencies is paramount. Players invest significant time and sometimes real-world money into these assets, and their trust hinges on the gaming about-us’s ability to secure these assets.

When a about-us fails to secure these assets, the results are devastating for both players and the about-us alike.

Hence, any blockchain gaming about-us that wants to be taken seriously needs a top-notch custody solution that safeguards these assets and instills player confidence that their assets are safe, even if the about-us were to go under.

Learn More

Fortifying digital assets

Two Main Ways Businesses Secure Their Digital Assets

Just as retail investors have the option between “cold” and “hot” wallets to store their digital assets, institutions also have options when it comes to securing their digital assets. Here are the two main ones:

Custody Solutions

Self-Custody Solutions

Custody Solutions

Third-party custody solutions involve entrusting the safekeeping and management of digital assets to an external service provider. These custodians are often regulated financial institutions with expertise in securing digital assets using features such as multi-signature wallets, cold storage, and 24/7 monitoring etc. In terms of additional value-add, they might also provide services such as secure storage, transaction management, and even insurance against theft or loss.

Here are some of most reputable third-party custodians now:

The exchange giant Coinbase offers institutional custody solutions as part of its “Coinbase Prime” platform. The platform provides institutional Bitcoin custody, and storage for over 360 digital assets, including Ethereum, Avalanche, Maker, and many more.

Anchorage Digital is a regulated and compliant crypto management and custody platform. It is the first federally chartered crypto bank, and the platform provides services such as custody, staking , trading, financing, and more.

Gemini is a fiduciary and qualified custodian under New York Banking Law and is licensed by the State of New York to custody digital assets. They are regularly audited and subject to the capital reserve requirements and compliance standards of a traditional financial institution.

Security showdown

Comparing Custody vs Self-Custody Solutions

When it comes to securing digital assets, both custody and self-custody solutions have their own sets of advantages and drawbacks, and the choice between them hinges on the specific needs, capabilities, and risk tolerance of each business.

An in-depth understanding of their performance in several key business aspects, their trade-offs, and how they align with your business’s operational realities, risk profile, and strategic objectives is essential for making an informed decision that will effectively safeguard your digital assets.

Let’s take a look at how they stack up against each other:

1. Security

Custody solutions have the advantage of professional management and sophisticated security systems implemented by experienced third-party providers. These providers typically leverage high-level security measures like cold storage, multi-signature wallets, and advanced encryption, which can be highly effective, but are not immune to risks such as centralized breaches, internal vulnerabilities, and regulatory uncertainties.

Self-custody solutions leave the control of the private keys directly in the hands of the users. This model minimizes trust requirements and eliminates single points of failure, providing security through decentralization. However, the security strength here is largely dependent on the user’s actions, technical competency, and the robustness of their own security measures. The risk of human error and the need for strong personal security practices can be potential downsides.

Verdict:

While both types of solutions can provide strong security when correctly implemented and managed, self-custody solutions have a slight edge here since their lack of reliance on third-parties greatly limits the attack surface area available to bad actors.

2. Simplicity

Custody solutions often stand out for their simplicity and convenience. Users do not have to worry about the technicalities of securing their private keys or managing their digital assets, as these tasks are handled by the custody service. They provide a user-friendly interface, making it easier for those without technical expertise to engage in digital asset custody. This simplicity is often a significant advantage for organizations that may lack the resources or skills to manage their digital assets.

Self-custody solutions, while granting full control, might seem daunting due to their complexity. Users are in charge of securing their private keys, and managing these keys requires a solid understanding of blockchain technology. Losing these keys could result in the permanent loss of assets, adding to the perceived complexity.

Verdict:

For those prioritizing ease of use and who are less concerned about retaining full control of their keys, custody solutions are the better choice.

3. Risks

In terms of risks, custody solutions can be seen as a double-edged sword. On one hand, these platforms often have insurance policies and robust security measures to protect against the loss of assets, making them seem safer. On the other hand, being central points of control and storage makes them attractive targets for hackers. There’s also the risk of internal misconduct and issues related to insolvency.

Self-custody solutions, by virtue of their decentralized nature, significantly reduce the risk of loss due to hacking or insolvency. The key risk is the loss or theft of private keys, which would result in the permanent loss of assets.

Verdict:

While custody solutions come with assurances like insurance, they also bring potential risks like hacking and regulatory complexities. Self-custody solutions reduce these risks but place more responsibility on the user. As such, the safer option would depend on the specific needs and capabilities of the business.

4. Regulations

Custody solutions, as they act as a third party controlling the assets of their clients, fall under a more stringent set of regulations. They often need to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, obtain necessary licensing, and comply with specific financial and privacy regulations applicable to their region or across multiple regions if they have an Internationalal clientele.

On the other hand, self-custody solutions, due to the self-custody nature of their operation, somewhat alleviate these regulatory pressures from businesses. The users (institutions) interact directly with the blockchain, which gives them full control and responsibility over compliance. However, the businesses themselves must ensure their operations comply with all relevant regulations as they are ultimately responsible for the security and management of their assets.

Verdict:

While it might seem that self-custody solutions have an edge in terms of fewer regulatory requirements, it’s crucial to understand that the regulatory landscape in the crypto world is evolving. As regulators catch up with the advancements in technology, self-custody services might also see increased scrutiny.

5. Flexibility

Custody solutions often have restrictions on how and when you can access or move your assets. These may come in the form of withdrawal limits, transaction fees, or wait times for transactions to be processed. While these restrictions are generally in place for security reasons, they can limit a business’s ability to react quickly to market changes or take advantage of opportunities as they arise.

With a self-custody solution, businesses have direct control over their private keys and assets, meaning they have the ability to manage their funds however they see fit. This is crucial for businesses that may need to quickly move funds or react to market changes. It also allows for customized security measures based on the specific needs of the business.

Verdict:

While custody solutions offer simplicity and potentially high levels of security, they may not provide the flexibility that businesses need in the rapidly moving digital asset landscape, which makes self-custody solutions the more favorable option in terms of flexibility.

Unveiling the surge

The Rising Popularity of Self-custody Solutions

Self-custody solutions have been gaining traction in the realm of digital asset custody, propelled by evolving technologies and a shifting perception of risk. Two primary drivers of this trend include the advent of multi-party computation (MPC) and the growing awareness of vulnerabilities associated with third-party custodians.

Innovation and Technological Advancements

New technologies and innovations such as Multi-Party Computation (MPC) and Multi-Signature Wallets are making self-custody solutions more secure and easy to use. This is drawing more businesses and individuals towards these solutions.

Multi-Party Computation (MPC)

Multi-Signature Wallets

Multi-Party Computation (MPC)

MPC is a cryptographic protocol that allows multiple parties to jointly compute a function over their inputs while keeping those inputs private. It is a real-world application of zero-knowledge proofs which allows the blockchain to prove that a transaction is valid without revealing the sender, receiver, or amount involved.

In the context of digital asset custody, MPC allows businesses to securely generate, use and store private keys across multiple devices. This significantly mitigates the risk of a single point of failure, as the private key no longer resides in a single location.

The application of MPC in self-custody solutions has made self-custody a much more viable and secure option for businesses, enhancing their ability to maintain full control over their digital assets while ensuring security.

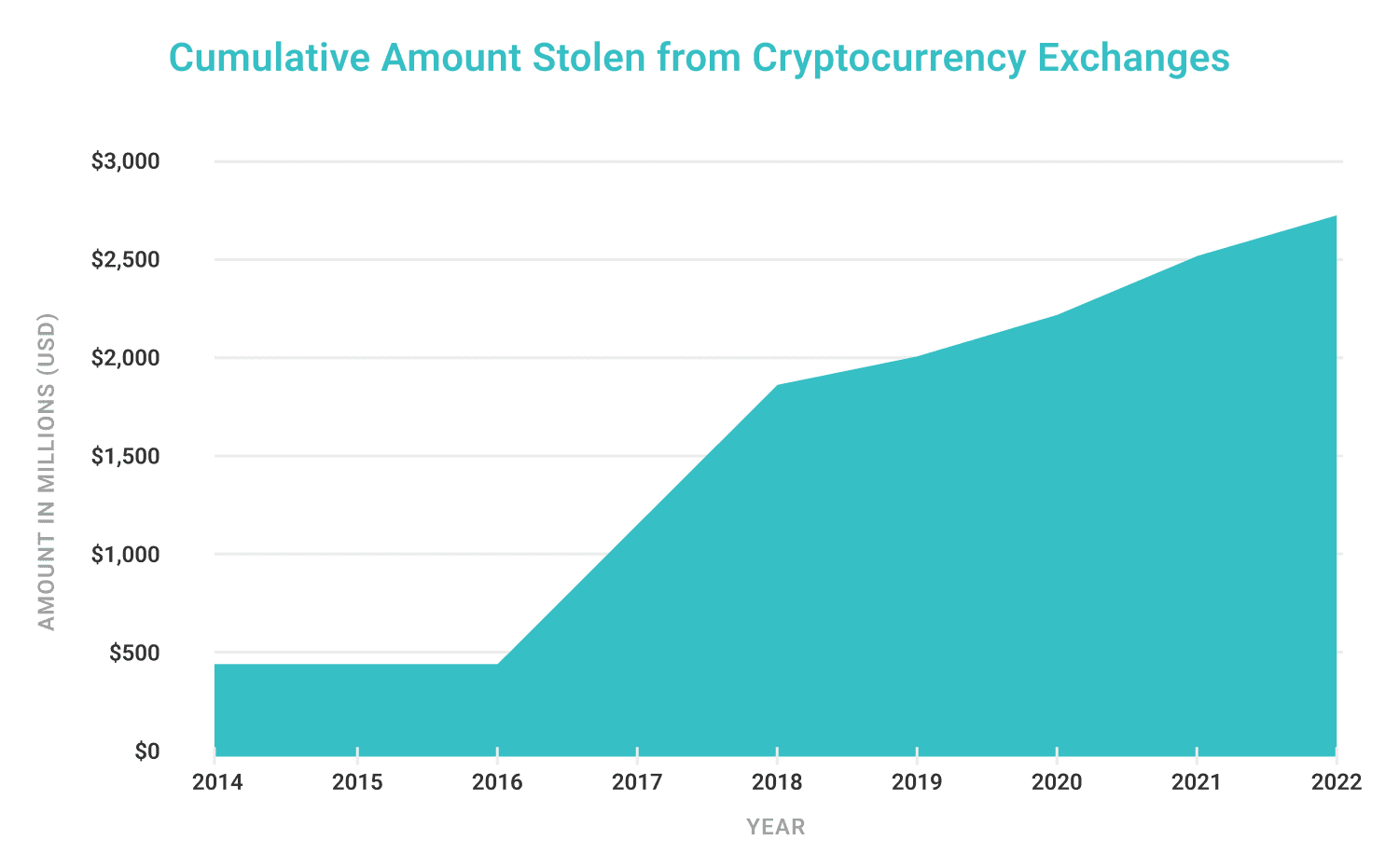

Security Breaches and Third-Party Risks

Several high-profile security breaches of custody solutions have underscored the inherent risks of centralizing digital assets. These incidents have highlighted how custody solutions can be lucrative targets for hackers, leading to a significant loss of digital assets.

On the contrary, self-custody solutions spread the risk, as each business manages its own assets, making it less appealing to attackers looking for a large payoff. This reality, coupled with the growing sophistication of self-custody solutions, is prompting many businesses to reconsider their dependence on third-party custodians.

Mastering digital asset custody: a business imperative

Final Thoughts

Choosing the right method of digital asset custody is paramount for any business that operates within the cryptocurrency and blockchain sphere. Whether you opt for a custody solution, rely on a self-custody approach, or utilize a hybrid of the two, your choice needs to reflect the unique needs and concerns of your enterprise.

As we navigate the evolving landscape of digital assets, self-custody solutions are increasingly gaining traction. Their promise of enhanced security, transparency, and control is reshaping the way institutions manage their digital assets. CoinsDo, with its distinctive Trusted Shard Computation technology, is at the forefront of this transformation, empowering businesses to take control of their digital assets while providing an unparalleled level of security.

Nonetheless, it’s important to remember that the most effective custody solution will always be the one that aligns best with your business objectives and risk tolerance. As the digital asset ecosystem continues to mature, ensuring secure, flexible, and efficient management of these assets will remain the cornerstone of success in this innovative field.

Elevating digital asset protection

Your Partner in Self-custody Digital Asset Custody Solutions

CoinsDo provides businesses with institution-grade, self-custody digital asset custody capabilities.

Powered by our proprietary Multiparty Computation (MPC), CoinsDo facilitates a secure, regulated ecosystem for clients to store, transfer, and govern their digital assets with lightning-fast speeds, full control, and utmost safety.

Your queries answered

Frequently Asked Questions

I still don’t really understand what CoinsDo is about. How does it work?

What makes CoinsDo different from other digital asset custody solutions?

How secure is CoinsDo?

How does CoinsDo simplify the process of digital asset custody and management?

How many blockchains and tokens do you support?

Can CoinsDo integrate with our existing systems?

What regulatory requirements does CoinsDo comply with?

Can I trial CoinsDo before making a commitment?

What kind of support does CoinsDo offer?

Try Out CoinsDo for Free!

We provide you with institutional-grade digital asset self-custody and management capabilities that are: