8 min read

Why Using a Non-Custodial (Self-Custody) Wallet is Safer for your Crypto?

The collapse of FTX has sent shockwaves through the crypto industry, putting assets under its custody at risk and unlikely to be recoverable. This has shattered trust and confidence in centralized custody platforms like exchanges, leading investors to move their assets to non-custodial (self-custody) wallets for added security.

The domino effect has also been seen, with at least 16 crypto firms halting withdrawals in the two weeks following FTX's downfall. This highlights the risks of relying on centralized entities to protect your crypto assets, or more precisely, allowing someone else to hold private keys that have access to your crypto assets on your behalf.

Fully relying on a centralized entity such as a crypto exchange to hold your crypto is risky. Regardless of how much you trust the exchange, you can’t fully ensure that all funds are fully redeemable at any point in time, given that FTX’s billions of dollars are just gone in a matter of days.

In this article, we will give you a brief overview of the concept of a private key in crypto, what makes you the real owner of your crypto, different types of wallets, the difference between Custody and Self-Custody (Non-Custodial), and some recommendations for keeping your crypto 100% safe at all times.

Definition and Purpose of Crypto Wallets

A crypto wallet is a tool that allows you to store and manage your digital assets securely. However, contrary to popular belief, crypto wallets don’t store cryptocurrency directly. Instead, they hold the private keys needed to access your assets on the blockchain. Without your private key, you cannot access or transfer your crypto.

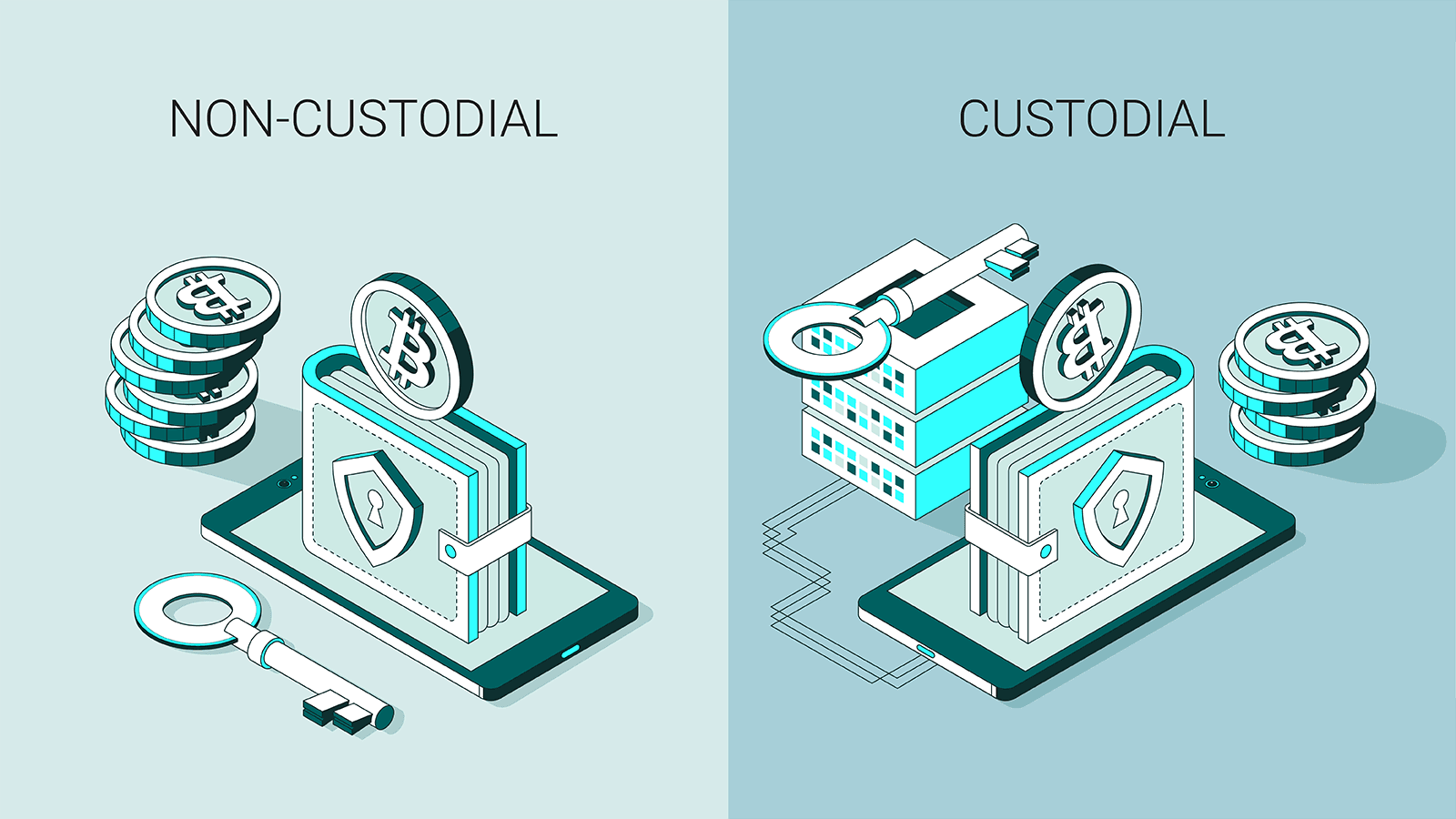

What is a Custodial Wallet?

As the name suggests, a custodial wallet means your assets are parked in someone else's wallet, which they can move around using their private key.

There are way more custody wallets than self-custody wallets in the market, and they appear in many different ways. It can be a mobile app wallet that requires you to sign up or an exchange. Whenever you sign up for an account in a centralized crypto exchange (CEX), you will be given an address at which you can deposit assets into it. Assets are stored in a communal wallet, and what you are left with from the asset custodian is an I Owe You (IOU).

To withdraw your assets, you have to make a request with your asset custodian, and they will first go through a verification process only then transfer your assets to your designated address using their private key.

Here is a list of benefits and drawbacks.

Advantages of Custodial Wallets

1. Convenience

You can trade instantly on a centralized exchange using the custody wallet you are currently using.

2. Cheaper Gas Fees

Because tokens and coins are simply figures in your asset custodian database, no actual transactions are made on the blockchain, and therefore, no gas fees are incurred.

3. Seed Phrase Not Required

A custodial wallet is password-protected and can be recovered using email or other methods, so there is no need to remember a seed phrase.

4. Accessibility

A custodial wallet is centralized, device-agnostic, and usually web-based, making it accessible from anywhere in the world.

Disadvantages of Custodial Wallets

1. Less Secure

You have no control over who has access to the private key holding your assets.

2. Provider-Reliant

If the company providing the custodial wallet goes out of business, you may lose access to your assets.

3. Lack of control

You have no control over how your assets are used or stored, as you do not hold the private key.

4. Cost

Some custodial wallets may require a recurring fee for their services.

Examples of Custodial Wallet for Individuals

Examples of Custodial Wallet for Institutions

What is a Non-Custodial Wallet?

A non-custodial wallet, also known as a self-custody wallet, allows you to control your private keys and, therefore, your crypto assets. It does not rely on any third party for security or access.

Key features include:

- Full control over private keys.

- Enhanced privacy and security.

- Support for a wide range of cryptocurrencies and decentralized applications (DApps).

Types of Non-Custodial Wallets

1. Software Wallets (Desktop and Mobile)

Examples: MetaMask, Trust Wallet, Exodus.

Features: Stores private keys on your device and is often used to connect to Web3 applications.

2. Hardware Wallets

Examples: Ledger Nano S, Trezor.

Features: Physical devices that store private keys offline, making them immune to hacking attempts.

3. Paper Wallets

Features: Involves printing your private keys on paper. While secure from online threats, it’s vulnerable to physical damage or loss.

Advantages of Non-Custodial Wallets

1. Full Control Over Private Keys

With non-custodial wallets, you—and only you—hold the keys to your crypto. This eliminates the risk of a third party mismanaging your funds.

2. Enhanced Security and Privacy

Since you control the keys, the risk of hacks or misappropriation by exchanges is minimized. Non-custodial wallets also allow for anonymous transactions without sharing your personal information.

3. Flexibility and Autonomy

Non-custodial wallets support a broad spectrum of cryptocurrencies and decentralized applications, giving you the freedom to interact with Web3 ecosystems directly.

Disadvantages of Non-Custodial Wallets

1. Responsibility for Security

You must safeguard your private keys and seed phrases. If you lose them, you lose access to your assets permanently.

2. Risk of Losing Access

Unlike custodial wallets that offer password recovery, non-custodial wallets have no way to reset passwords. The seed phrase is the only recovery option.

3. Complexity for Beginners

Setting up and managing a non-custodial wallet requires some technical knowledge, which may be daunting for beginners.

Non-Custodial Wallet for Individual Investors and Tech Professionals

- Metamask (Most widely used Web3 wallet)

- Exodus

- Trust Wallet

- imToken

- Coinomi

Conclusion

Choosing the right wallet is a crucial decision for securing your digital assets. While non-custodial wallets offer unparalleled control and security, they also require careful management of private keys. By prioritizing security and personal control, you can ensure your crypto assets remain safe and accessible.

FAQs

1. What happens if I lose my seed phrase?

Unfortunately, if you lose your seed phrase, you permanently lose access to your assets.

2. Are non-custodial wallets safe from hackers?

While no wallet is 100% safe, non-custodial wallets reduce risks significantly by keeping private keys offline.

3. Can I switch from a custodial to a non-custodial wallet?

Yes, you can transfer your assets to a non-custodial wallet by generating a new address and initiating a transfer.